Foreclosure is a powerful buzz-word.

It seems like just about everyone who is in the market to buy a home right now wants one. But the simple truth is that a good portion of the remaining foreclosure properties here in Orlando aren't all they are cracked up to be. In other words, not always a great deal. Why? Well, first off many of the best deals have been bought up and the inventory of existing homes for sale is at the lowest level in over 18 months. A savvy real estate agent will look at foreclosures, bank owned properties, as well as all other properties for their clients to find every possible great deal out there.

So, what does make foreclosure homes so appealing? Perception of value. I mean, a home is being offered for sale for less for less than the current owner paid for it- therefore it must be a good deal....right? Well, this is not necessarily true. Each foreclosure should be evaluated on a case by case basis. For example, many homes have fallen into foreclosure after being occupied for only two or three years. And in that time frame a lot of buyers were getting 100% financing. There is more than likely a negative equity situation in that home. Compare that to a home which has been with the same owner for generations. It mostly has been paid off. Let's say this owner passes away and hands the property down to a relative who wants to unload it quickly. Chances are....the latter situation might provide the better opportunity for a buyer.

Foreclosures are not be for everyone. If the owner of a property in foreclosure is not making note payments....what are the chances the home is being maintained properly? Repair costs for updating, needed repairs and/or house abuse may push the price right back up. Granted, if you have hands on construction experience, a lot of patience (purchasing a foreclosed property can take a lot of time), vision and most importantly cash on hand- a foreclosed property might be right for you.

The bottom line on the bottom line. Good homes at fair prices are not on the market very long- whether it is a property in foreclosure or just a great deal. With the help of an astute Realtor you will have a leg up on others in the race to find the good ones fast. I have helped clients purchase foreclosure properties, and in other cases I have helped clients evaluate non foreclosure properties which are "move-in"ready". In many cases (I should say most), the non foreclosure property proves to be the better deal.

Feel free to test me on this. If you are interested in purchasing real estate fill out the information on my dream home finder and you will be mailed all the properties that fit your criteria as soon as they hit the market....automatically. This includes foreclosures and bank owned properties. Or get in touch with me and I can set this up for you.

Don't sell yourself short by only looking at properties in foreclosure. There may be a better deal waiting for you, with a lot less hassle.

Whether you have become a first-time homebuyer a few months ago, with flowers blooming around the yard and the promise of an $8,000 tax credit OR whether you have owned your home for years- with winter approaching, you may find yourself dealing with frozen pipes and clogged gutters that once upon a time may have been someone else’s responsibility. This primer will help you pick out the tools you’ll need to prepare for the challenges of the colder months. Yes....even Floridians need to be prepared!

1. Outdoor ladder

Even if you don’t plan on cleaning your own roof and gutters it’s important that you have access to these higher places in case of an emergency

2. Gutter scooper

You should clean your gutters at least twice a year, and a pre-winter unclogging is crucial to prevent potential rain or snow damage. All you really need is that ladder you bought and a reliable pair of gardening gloves to scoop out the leaves and goop.

3. Pruning shears/saw

If you have any large trees near your house, Be sure to remove any dead branches that are near the house or where people spend time outdoors.

4. Snow shovel

you probably want to add a snow shovel to your list of wintertime necessities. And if you wait to buy until that first snowflake falls, snow removal equipment may be harder to find.

5. Rake

To dispose of dead leaves.

6. Duct tape

The practical uses for duct tape are boundless, so it should come as no surprise that it’s also a practical way to seal the insulation for your water pipes.

7. Outdoor faucet cover

You’ll want to make sure any water pipes that are exposed to the outdoors are insulated, including any faucets, which are also known as exterior hose bibs.

8. Wet-dry vacuum

A wet-dry vacuum is certainly useful beyond the winter months, but it may come in especially handy when precipitation is falling and pipes run the risk of bursting. It will give you the ability to quickly clean up any leaks or drainage issues until you’re able to fix the problem for good.

9. Plastic window insulation

If you feel a draft when you sit near a window, you’ll want to put storm windows high on your growing list of things to do. But until you’re financially ready to make that purchase, a suitable substitute is plastic window insulation.

10. Outlet and light switch gaskets

You may not think much cold air can leak into your house through outlets and light switches, but all the cracks and holes in your home can quickly add up in your winter heating bill. Every wall plug and every wall switch is a place where cold air can come in.Foam gaskets that fit inside your light switches and outlets are an easy and inexpensive way to block some of the cold air.

Have a great Holiday Season and stay warm.

Remember, Orlando Real Estate Matters!

Michael

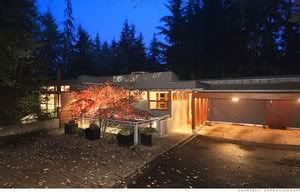

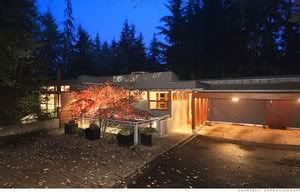

Ok so the home is in Vancouver, maybe a bit pricey at first glance, but come on! Living in the Cullen house...simply priceless! Click here for the details and slideshow.

Homes not selling unless they are foreclosures?

Not true.

I just sold a beautiful 2 bedroom home in Thornton Park for $515,000 that closed last Friday. I represented both sides of the transaction. The home was my listing, and I marketed and found the buyers who ultimately purchased the property. This was not a short sale or a foreclosure. The home was on the market over 600 days with a number of different Realtors prior to me....I listed the home and got it under contract in 69 days.

Now May be the Best Time to Sell Your Home

Why?

- Even considering significant price decreases in some markets over the past 18 months, a home purchased several years ago could very likely sell for a profit today.

- While your selling price might be less than anticipated, you very likely can compensate for that on the buying side of the equation in today's market. There are still great deals out there, and interest rates are still hovering around all time lows. Remember, when the market turns...and it will...you may be able to get an outstanding price for your home, but if you will be purchasing another home you will be on the other side of the transaction. You will be scrambling, and probably will be forced to pay a premium for property under those market conditions.

- I would remind you of this- While short-term market conditions can fluctuate, housing continues to represent a strong ling-term investment. Since the start of real estate record keeping in 1968, national median existing-home prices rose every year until 2006 - a period that included early recessions and sales decline.

- The market is experiencing a major decline in available home inventory- as short sales and foreclosed properties continue to disappear.

It all comes down to this. Homes are selling. The Realtors who are selling homes in this challenging market are doing more than just posting their listing on the MLS, putting a sign on a yard and hoping for the best.

I made this particular sale happen for both buyer and seller by working with the appraiser to explain the value of this property, by utilizing many different media to get the word out to everyone and targeting a very specific set of buyers that would be interested in a home like this. These are just a few of the reasons I was able to sell 27 James Avenue in such a short time, and to get accomplished what the Realtors who had this listing before me--- could not.

If you are considering putting your home on the market, I would welcome the opportunity to evaluate your home and give you my opinions, thoughts and suggestions.....all for free. Just get in touch and I will try to help you anyway I can.

The words "first time home buyer" are missing- because the benefits go well beyond that particular group. Can you benefit? Take a look....more to come.

By STEPHEN OHLEMACHER, Associated Press Writer Stephen Ohlemacher, Associated Press Writer –

33 mins ago WASHINGTON – Buying a home is about to get cheaper for a whole new crop of homebuyers — $6,500 cheaper.

First-time homebuyers have been getting tax credits of up to $8,000 since January as part of the economic stimulus package enacted earlier this year. But with the program scheduled to expire at the end of November, the House voted 403-12 Thursday to extend and expand the tax credit to include many buyers who already own homes. The Senate approved the measure Wednesday, and the White House said President Barack Obama would sign it Friday.

Buyers who have owned their current homes at least five years would be eligible for tax credits of up to $6,500. First-time homebuyers — or anyone who hasn't owned a home in the last three years — would still get up to $8,000. To qualify, buyers in both groups have to sign a purchase agreement by April 30, 2010, and close by June 30.

"This is probably the last extension," said Sen. Johnny Isakson, R-Ga., a former real estate executive who championed the credits.

The homebuyers tax credit is one of two tax breaks totaling more than $21 billion that was included in a bill extending unemployment benefits for those without a job for more than a year. The other would let companies now losing money recoup taxes they paid on profits earned in the previous five years.

"We are still in a world of economic hurt, and Congress must continue to act boldly and creatively," said Sen. Max Baucus, D-Mont., chairman of the Senate Finance Committee. "With the right mix of tax breaks and investments we will get through this recession and get folks working again."

The real estate industry has been pushing to extend and expand the housing tax credit. About 1.4 million first-time homebuyers have qualified for the credit through August. The National Association of Realtors estimates that 350,000 of them would not have purchased their homes without the credit.

Extending and expanding the tax credit for homebuyers is projected to cost the government about $10.8 billion in lost taxes. While the measure passed the Senate by a 98-0 vote, Sen. Kit Bond, R-Mo., questioned its efficiency in stimulating home sales.

"For the vast majority of cases, the homebuyer tax credit amounted to a free gift since it did not affect their decision to purchase a home," Bond said. "And for the small minority of buyers whose decision was directly caused by the credit, this raises the question of whether we are subsidizing buyers who may not have been able to afford buying a home in the first place."

The credit is available for the purchase of principal homes costing $800,000 or less, meaning vacation homes are ineligible. The credit would be phased out for individuals with annual incomes above $125,000 and for joint filers with incomes above $225,000.

The credit would be extended an additional year, until June 30, 2011, for members of the military serving outside the United States for at least 90 days.

Expanding the tax credit for money-losing companies is projected to cost $10.4 billion.

The business tax break would allow money-losing companies to use current losses to offset taxable profits earned in the previous five years, giving them refunds of taxes paid in those years. Under current law, businesses with annual gross receipts of more than $15 million can claim losses back only two years.

The tax break would help industries suffering losses in 2008 or 2009, including retailers, homebuilders and newspapers. Congress included a scaled-back version of the tax break — for companies with revenues of $15 million or less — in the economic recovery package enacted in February. The new tax break would be available to companies of any size, providing a quick source of cash.

The U.S Chamber of Commerce has been a big backer of the tax break for money-losing companies.

"It frees up capital that they can use to maintain jobs and potentially even hire new people as the economy returns," said Caroline Harris, senior tax counsel for the U.S. Chamber of Commerce.

The tax breaks would be paid for largely by delaying a tax break for multinational companies that pay foreign taxes. It was passed in 2004 and originally was to have taken effect this year, but would now be delayed until 2018.

You would think that all this attention would have weeded out predatory practices in the mortgage industry, Not so. In the "new world" of loan modifications, refinancing, and short sales come a whole new batch of shady dealings. Of course many have thought of the mortgage industry as a whole has been the "whipping boy" for everything that has gone wrong with the economy. But just as there are good and bad Doctors, Accountants etc. the same goes for mortgage providers. If you have any questions regarding lenders, or need help finding an appropriate one for your needs...I can help you. In the meantime, be aware of what is going on. Take a look at this article. Michael

Top 3 Real Estate Mortgage Scams: What You Need to Know

RISMEDIA, November 2, 2009—Being a homeowner is one of the biggest dreams for the American people. Due to record numbers of homeownership and cheap mortgage rates, individuals who did not own a home previously are now looking for mortgages for financing their ambitions. On certain occasions, the dream of homeownership is associated with a cost that exceeds the mortgage.

RISMEDIA, November 2, 2009—Being a homeowner is one of the biggest dreams for the American people. Due to record numbers of homeownership and cheap mortgage rates, individuals who did not own a home previously are now looking for mortgages for financing their ambitions. On certain occasions, the dream of homeownership is associated with a cost that exceeds the mortgage.

For finding out how much your mortgage is going to cost you, a loan mortgage calculator often works as a user-friendly tool. Nevertheless, this tool can’t save you all the time. Similar to other forms of investment, real estate mortgage loans are also subject to scams. Mortgage frauds and scams can make you lose thousands of dollars on interest as a minimum because of excessive fees and other hidden costs. The worst that can happen is that you can lose your home to foreclosure.

According to industry professionals, there are three principal or familiar types of real estate fraud:

1. Identity theft via mortgage request

2. Bait and switch

3. Loan flipping

For preventing scams, it has been witnessed that offense is the best defense. Understand the truth and don’t hesitate to make queries.

Bait and switch is a fraudulent sales technique where a loan product is publicized at a lucrative rate (bait). However, the product or rate is subsequently changed for the gain of the lender (switch). This is an utterly illegitimate and deceitful practice. For instance, one interest rate is assured at the time of selling a loan, but a bigger rate is provided at the time of closing.

When you’re obtaining a pre-approval or mortgage quote, you believe that your question with the lender is secret, right? You’re wrong. On many occasions, important financial details about you and your mortgage requirements are hacked by vying lenders. This can happen within 24 hours of your credit bureau inquiry. Your loan officer is even unaware of this. Many firms provide countrywide accessibility to your financial details to the lenders and everybody in your city who requested for a mortgage within the last 24 hours. Any other lender can talk to these individuals the following day and give them a pre-approval for an improved mortgage loan.

One more dilemma is mortgage solicitation through telephone, the Internet or door to door. These scams involve filling in an application through fax, the Internet or over the telephone and often the rates are phony. However, it is not the largest issue to be bothered about–it is nothing but identity theft. Even though the rates are legitimate, the company would get all your important details such as your social security number that can result in mortgage scam or identity theft.

Another type of mortgage scam that is prevalent in the real estate industry is loan flipping. Loan flipping denotes frequent refinancing of a mortgage within a small time frame with very small gains to the borrower. It takes place when a borrower can’t keep up with the planned payments or constantly combines other unsecured loans into a new secured loan at the request of a lender. Lenders flipping loans ask for too much origination fee with every consecutive refinancing. They might ask for these fees on the basis of the whole loan amount, not only on the increased amount summed up with the loan principal through refinancing. In addition, every refinancing might attract prepayment penalties that can be funded as a portion of the overall loan amount, accumulating the debt of the borrower.

If you’re buying a home, looking for a home equity loan or considering a mortgage refinance, it is better to work with a trustworthy lender. You must shop around and do some homework to get the best offers. Try to stay away from furnishing any details until you’re confident that the company or individual you’re talking to is right for you.

I came across this article this morning that really does a good job of summarizing what I have been saying for the past couple of months. All in all, whether you are an investor from another state or a Floridian, waterfront property in Florida (whether it be on a lake in Orlando, beachfront, or riverfront) has held it's value better than many other real estate investments over the last few years. But still there are great deals out there. Give a read and let me know what you think. If you are looking for waterfront property (or any property throughout the state) I can help you.

Several years back I decided to purchase an ocean view condo at the beach in Ormond By the Sea which is on the east coast of Florida just north of Daytona. There are many reasons why I decided on "Fairwind Sbores" but the biggest was that I felt that Ormond was very much undervalued in comparison to other beach communities close to Orlando (only 70 minutes from downtown). Plus I liked the sleepy nature of the town, and the building was a low rise which is what I was looking for.

Anyway, I started to write in the Fairwind Shores newsletter and I thought I would share this month's column because I thought it might be of interest and relevant if you are thinking about purchasing a condominium- particularly one that you may use as an investment property. You will see I have added notes here and there that I think might make the article more relevant to you. Here it is:

Michael Gonick's Real Estate Tips - Fairwind Shores- Volume I I wanted to write some items in the next couple of newsletters regarding the state of Fairwind Shores because I look at

our condominium from a fairly unique perspective:

First, I am an owner.

Second, I am a real estate agent.

Third, I have sold or found buyers for a number of units in Fairwind Shores.

You can say I am bullish on our buildings. A good portion of my business is Orlando based. I have little interest in selling or bringing buyers to any other condo or development in Ormond Beach except for our building. Why?

Because I know ours is the best in Ormond By the Sea for a number of reasons.

A general rule of thumb- if a Realtor purchases in a building you know that is a good sign!

In this issue, I would like to put my Realtor hat on and tell you, from a Realtor's perspective what makes our buildings attractive to potential buyers and renters. I will touch upon some things we can do to make our residences even more appealing to prospects but get into more detail next time on this.

As an owner I would like my unit to have the maximum "value". As I see it, in this economy, this is good for all of us.

What makes Fairwind Shores unique and the biggest selling points...

1. Basically, every unit in our building is designed to be a corner unit.

2. We have a tennis court.

3. We have lobbies.

4. We have underground parking

5. We have elevators

6. Our rental policies

7. Cleanliness and new additions

1. I thank the architects of our building for the wonderful layout making every unit basically a corner unit- windows with views of the ocean on multiple sides as opposed to the "tunnel" effect that the other buildings in our area have. I think the builders of Fairwind Shores were ahead of their time and it is the single biggest selling point of our condos.

When looking at a condo building, what are the unique style and attributes that set it apart from all the rest?2. Some of you may look at the tennis court being empty and think to yourself there may be a better usage for that space. I beg to differ. First off, I am a tennis player! YES I am the guy you see "serving" on the weekends and playing with my buddies. Is there another condo that has its own tennis court around us? I don't think so. It is an attractive feature not only for prospective buyers but for renters as well. Don't take the tennis court for granted. If the court looks good like it does now....big selling point. If it is neglected, it is a big negative.

When deciding on a condo, it isn't just the amenities that are important, it is how well they are maintained. How appealing is the property from the road? Is the lawn maintained? Are their noticeable signs of disrepair?

3. Same goes for the lobbies. Our lobbies are a huge selling point for safety and security. Honestly, in my humble opinion, spending a couple of bucks to make them more attractive and updated would be a good investment for us. I think it should be something to consider in the near future. The saying is "You have only one chance to make a first impression".

Our condo building is the only low rise to have lobbies at all, and it was one of the major reasons I decided to purchase. Visitors must be buzzed in and I can monitor who is at the front door from my TV screen. 4. The fact that we have covered, underground parking is a major plus. Safety, security and also less wear and tear on our vehicles.

Also a unique feature of our buildings. 5. Our buildings have elevators which make units viable on all levels to people with physical disabilities who might only be able to purchase on the first floor in other buildings without elevators.

When you are looking at a condo that you may use as an investment, be thinking about amenities that would make it attractive for the most amount of people. 6. Our rental policies, including renting monthly is very attractive. First off, our buildings will stay in better shape than those buildings that rent weekly. Fairwind Shores, because of our rental policies, makes our condominium more attractive to owners (like me) who want to have their condo as primary residence. I wouldn't even have considered a weekly rental building....yet I like to know that there is the opportunity to rent out if I wanted to here.

7 Our property appears to be cleaner and better maintained than at anytime since I purchased here 5 years ago. Bravo to whomever is responsible- I guess this would be the board as well as the crew keeping our place fresh. The lawn looks great. The additional outdoor shower coming off the beach on our property is brilliant. I would never have thought of it but I would definitely point it out to prospects if I had units listed and/or buyers interested.

Our best interest, as I see it is to put our best foot forward at all times in a difficult economy and being able to showcase

the fantastic amenities and unique attributes of our condominium complex.

Please feel free to contact Michael Gonick, Realtor from Coldwell Banker at 407-383-2563 or

michael@michaelgonick.com.

Bottom line items- It is just common sense to review condo documents, meet with the board President, talk to residents and get a "feel" for the property. If you have the opportunity to stay at the development (even as a renter) before purchasing I would recommend that. As always, have a Realtor involved. It should cost absolutely nothing to you to have a buyer's agent (those fees should be paid by the seller) and the insight and perspective might prove to be invaluable.

Well if you love modern contemporary architectural style you may have been sitting on the fence waiting for something dramatic to happen with this property...and it has. My listing at 26 S. Lawsona Boulevard has been reduced $50000 to the unbelievable price of $499,000. Click

here to see more and call me soon to preview if you are interested. This is a motivated seller and he wants it sold quickly.

I just listed a fantastic lot in College Park.

Beautiful cleared 152 ft deep lot in established neighborhood available to build the custom home of your dreams. Endless possibilities, fantastic location a few blocks away from Lake Adair and the shopping, restaurants and all that College Park has to offer. More pictures, map, survey and info

here.

As part of their "Cinema Art" program, the new Plaza Cinema Cafe features critically-acclaimed independent films, alternative productions, restored classics and first-run foreign movies. On Wednesday and Thursdays only you can see their feature presentation for free...simply by clicking here and printing your free voucher. Bring it to the theater and you are good to go for any of the show times on Wednesday and Thursday. Your parking is free for 3 hours with validated ticket.

This week's featured movie is "Pandorum", and you can get showtimes and info here as well as a map to the theater. For parking enter on S. Court Aveune from either Pine or Central.

Support the Downtown Arts District. It's good for Orlando.

Well.

I just don't think it is fair.

San Jose PLUS Palo Alto PLUS Santa Clara = Number 24.

What the heck? Detroit gets the assistance of Ann Arbor and Ypsilant! (Ypsilant?)

Do not even get me started about Tampa/St Pete.

Please do not let our 27th placement deter you from moving to Orlando. Surely if we were allowed to add Daytona Beach to Orlando we would have been able to leapfrog over Milwaukee.

After all, I hear they have some great high school football in Daytona.

Here is the list of the top 50 "sports cities" courtesy of The Sporting News.

1. Pittsburgh

2. Philadelphia

3. Boston

4. Chicago + Evanston

5. Los Angeles

6. New York

7. Phoenix + Tempe

8. Miami

9. Dallas-Fort Worth

10. Detroit + Ann Arbor + Ypsilanti

11. Houston

12. Nashville

13. Atlanta

14. Washington

15. Tampa-St. Petersburg

16. Minneapolis-St. Paul

17. Raleigh + Durham + Chapel Hill, N.C.

18. Denver + Boulder

19. Salt Lake City + Provo

20. Indianapolis

21. Anaheim

22. Cleveland

23. Charlotte

24. San Jose + Palo Alto + Santa Clara

25. New Orleans

26. Milwaukee

27. Orlando

28. Baltimore

29. Cincinnati

30. St. Louis

31. San Diego

32. Portland

33. Oakland + Berkeley

34. Columbus

35. San Antonio

36. Toronto

37. Oklahoma City + Norman

38. Austin, Texas

39. Vancouver

40. Buffalo

41. Gainesville, Fla.

42. Calgary

43. Storrs, Conn.

44. East Lansing, Mich.

45. Montreal

46. San Francisco

47. Memphis

48. State College, Pa.

49. Kansas City

50. Jacksonville

This from the Orlando Business Journal----

High unemployment and housing crisis be darned: Florida is still among the most popular states when it comes to where people want to live.

Only California is more popular, taking the No. 1 spot for the sixth year in a row as the place Americans would like to live if they didn’t live in the state they now live. Hawaii came in third.

“The most popular states and cities where large numbers of people would like to live tend to attract tourists and business,” according to a Harris news release. “They are places where people like to take vacations and where companies like to have their offices and factories.”

Oddly enough, however, no Florida cities were among the top destinations for resident wannabes.

New York City topped the list of cities people would most like to live in or near, followed by Denver and San Francisco.

The other most popular states were:

Texas (No. 4), Colorado (No. 5). Three states tied for sixth place: Arizona, North Carolina and Washington state.

The other cities on the top 10 are San Diego (No. 4), Seattle (No. 5), Chicago (No. 6), Boston (No. 7), Las Vegas (No. 8), Washington, D.C. (No. 9), and Dallas (No. 10).

The poll of 2,498 U.S. adults took place Aug. 10-18.

This is the longest streak since the National Association of Realtors began recording keeping in 2001....with gains all over the country with the biggest gains outt West.

This from the Florida Association of Realtors dated Oct 1, 2009:

Record streak continues for pending home sales

WASHINGTON – Oct. 1, 2009 – Pending home sales have increased for seven straight months, the longest in the series of the index which began in 2001, according to the National Association of Realtors®.

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in August, rose 6.4 percent to 103.8 from a reading of 97.6 in July, and is 12.4 percent above August 2008 when it was 92.4. The index is at the highest level since March 2007 when it was 104.5.

Lawrence Yun, NAR chief economist, said not all contracts are turning into closed sales within an expected timeframe. “The rise in pending home sales shows buyers are returning to the market and signing contracts, but deals are not necessarily closing because of long delays related to short sales, and issues regarding complex new appraisal rules,” he said. “No doubt many first-time buyers are rushing to beat the deadline for the $8,000 tax credit, which expires at the end of next month.”

The Pending Home Sales Index in the Northeast jumped 8.2 percent to 85.3 in August and is 12.0 percent higher than August 2008. In the Midwest the index rose 3.1 percent to 90.8 in August and is 7.6 percent above a year ago. In the South, pending home sales increased 0.8 percent to an index of 104.6 and is 8.2 percent above August 2008. In the West the index surged 16.0 percent to 130.5 and is 22.3 percent above a year ago.

“There is likely to be some double counting over a span of several months because some buyers whose contracts were cancelled have found another home and signed a new contract to buy,” Yun explained. “Perhaps the real question is how many transactions are being delayed in the pipeline, and how many are being cancelled? Without historic precedents, it’s challenging to assess.”

Yun also noted that the data sample coverage for pending sales is smaller than the measurement for closed existing-home sales, so the two series will never match one for one.

NAR President Charles McMillan, a broker with Coldwell Banker Residential Brokerage in Dallas-Fort Worth, said first-time buyers need to act now. “Potential first-time buyers must make a contract offer very soon to have a reasonable chance of qualifying for the tax credit,” he said. “Congress needs to extend and expand this program because it’s stimulating the economy and reducing inventory close to price stabilization points.”

McMillan said a sizable number of homebuyers already in the pipeline could be let down because of the tight deadline. “We know there is a pent-up demand because sales are below normal levels for the size of our population. The faster we absorb excess inventory, the sooner we’ll turn the corner on home prices, prevent additional families from becoming upside-down in their mortgages, and give Wall Street the confidence to extend credit to other sectors,” he said. “Each home sale pumps an additional $63,000 into the economy through related goods and services, so the benefits of extending and expanding the tax credit far outweigh the costs.”

Yun said the forecast for home sales and prices depends very much on whether a tax credit is extended. “All we can say for certain is sales will decline when the tax credit expires because we are not yet on a self-sustaining recovery path. It also raises a risk of a double-dip recession,” he said. “Extending and expanding the tax credit is the best tool in our arsenal to encourage financially qualified buyers to stimulate the economy and help reduce the budget deficit.”

© 2009 Florida Realtors®

Pictured- UNDER CONTRACT 27 James Avenue in Thornton Park. For this transaction I represent BOTH buyer and seller.

Pictured- UNDER CONTRACT 27 James Avenue in Thornton Park. For this transaction I represent BOTH buyer and seller.

Buying a home is no small matter in any economy. Besides being the largest financial transaction many will ever undertake, it’s probably also the most complex. Sure you can try to “go it alone” but why not enlist the help of someone who knows the in’s and out’s of the paperwork and home buying process? Particularly when it won't cost you a dime.

A good Buyer's Agent will save their clients both time and money- usually, a lot of both. A good Buyer’s Agent can protect their clients from legal and financial disaster. It is true we are in the midst of a very lopsided buyer’s market. As I see it, all the more reason to have an agent like me on your side. The very best homes and the very best deals are still in demand. Many desirable homes come up and down quickly, and others get sold even before they are listed. A great Buyer's Agent has the contacts who often give a “heads up” on properties before they ever come onto the market. If you still aren't sold yet, read on.

Reasons You Absolutely Need a Buyer’s Agent When Buying a Home

At first, you may be able to convince yourself that you don't need a real estate agent to buy a home. As you find yourself sifting through papers you don't understand, you may begin to reconsider. There are many reasons to hire a real estate agent when house hunting - here are a few that come to mind.

- There is No Direct Cost to You

One misconception in real estate is that a home buyer pays commission. Not so. The seller pays all the commission, and if two agents are involved in the transaction, that same commission will be split between them.

- It Will Be Much Easier To Find Your Dream Home

Nowadays buyers can search the Internet and use similar tools that are accessible to realtors. Many of my clients enjoy browsing for homes on their own. I actually encourage it.. Unfortunately, some of the consumer real estate Internet sites are not up to date and particular homes may already have sold or been taken off the market. Still, it is helpful when my clients tell me about a home that they have found on the Internet or something they saw while driving around town. I can get a clearer picture of what they are looking for. It’s my business to know which neighborhoods appreciate the best here in Central Florida, which home has the killer kitchen you have always dreamed of, or which have the perfect back yard for your kids or pet. Someone like me can do the grunt work for you, and would be more than happy to do it. It is my job.

The rules of the game have changed. Sure, you can take on a new full-time job researching home values, but an experienced real estate agent will have already done the work and will be able to negotiate the best possible purchase price for you. For example, I have found over and over again that the initial offer on any given property can significantly help or hurt your chances of acquiring that home. Without a buyer’s agent you will be negotiating with one arm tied behind your back. In most cases, the seller has a real estate agent representing them – why shouldn’t you?

When making an important financial transaction such as buying a home, it's important to know that you are legally protected in case things don't go as planned. For example, when I draft a purchase agreement for a buyer, it will include certain contingencies that protect you from issues, such as a loss of financing, failed inspection or unfulfilled promises. If the situation warrants, you may be able to recoup your earnest money deposit or void your offer completely.

- Paperwork, Paperwork, Paperwork

Scaling the mountains of paperwork associated with buying a home should be your Real Estate Agent's job. There is a lot that goes on from the time a contract is executed and the closing date. Home Inspections, appraisals, repairs, insurance, contingencies...etc. A Real Estate Agent can prevent you from losing and forgetting paperwork or from signing on the wrong line. Without their help, you could miss things that may delay the process and push back your closing date.

- I like to think that I am doing a great service for the clients I work with by lowering their stress levels, simplifying the home buying process for them, and dare I say, making the process enjoyable. I do my job so you can do the things that you want to do- play with your kids, watch TV, travel etc.

- But it all comes down to trust. Like in many other service professions, not every Realtor is built the same. You should feel comfortable with your Real Estate Agent whether they represent you as a Buyer or Seller's Agent. I am asked many times to help people I know find a Realtor for them in another market. Whether my clients are here in Central Florida, or in the Northeast, or anywhere else in the country, I know these people trust me to do the right thing and I don't take my responsibilities lightly.

- Finally, according to the Journal of Housing Economics, 87% of all home buyers who use the Internet to search for homes also choose to use a buyer’s agent to assist them. I have only touched on a few of the many reasons why and would be happy to share with you many more.

If you use a good Buyer’s Agent, you should be served, not sold.

Hope this is helpful in some way. Feel free to contact me at anytime if you have questions. I truly welcome your feedback.

Before I come over to list your property, some think it is best to "tidy up" a bit. That's fine. You have to do what you have to do. But usually I am there to look through the clutter and figure out pricing and how to best market your home.

Before I come over to list your property, some think it is best to "tidy up" a bit. That's fine. You have to do what you have to do. But usually I am there to look through the clutter and figure out pricing and how to best market your home.

When we decide to move forward, it is extremely important to show your home's true potential. Not only what is but also what could be.

Regardless of the listing price whether it be $100,000 or ten million, here are 7 simple spruce up items you can do to help me show your home in the best light and make it attractive to potential buyers. Some are easy do it yourself projects and others may require professionals. Either way these items are well worth the effort and will help me help you get top dollar for your investment.

Let's start with the easiest and less costly and work our way up--

1) De-clutter and de-personalize–

Less is more and it doesn't cost a thing! Remove religious items, family photos, gadgets and knickknacks. You want your buyer to remember your house, not the wall of photos from your vacation in North Carolina.

2) Clean it up – I know you are busy, but grab the vacuum and the glass cleaner and get rid of those dust balls and smudgy windows. People do not want to envision themselves living in a dirty home.

3) Change out the hardware – Are your handles on your kitchen and bathroom cabinet doors dated? The most important piece of hardware is your front door handle. Make sure it looks good. Remember, a good first impression is priceless.it. Changing the hardware is a simple and cost effective way to modernize your space, making it look fresh and new.

4) Lights- Remove your old and tired light fixtures. Take a look at your cover plates. If they look outdated or stand out (in a bad way) change them out. Cover plates are cheap to replace yet make a huge difference in the appearance of a room. Oh and please do not have any burnt out bulbs. This is a pet peeve of MichaelGonickRealtor! I seriously think that subconsciously buyers decide not to buy homes that have a burnt out bulb anywhere in sight!

5) Paint – Freshen up the interior of your home with a new coat of paint. New paint smells great! Remember, neutral colors are best because they will make your rooms appear larger and will allow the buyer to envision their own furniture in the space.

6) Upgrade flooring – Now this depends on budget but if you can, replace old carpet with new or better yet...hardwood floors. If hardwood is way out of your budget, maybe tile or a good quality laminate will work (do me a favor and show me the laminate before you lay it!).

7) Kitchen Upgrades – The most important room in a home to many is the kitchen. If it’s not in your budget to do a total remodel, then consider replacing old appliances with stainless steel if appropriate. Appliances that look consistent will help make your home look uniform.

It is still a buyer's market, and you only have one chance to make a great impression. Do what you can to put your best foot forward and you will reap the rewards.

Hope this helps! If you have any questions, or if I can help in anyway....I am here for you.

Oh and if you have a friend that might like this sort of thing....send them to MichaelGonickRealtor!

Image above is one of my gorgeous listings.

1691 Palm Avenue in Winter Park

Home by Phil Kean

Often a Realtor will be asked, "So what do you think about the market?" "When is it going to get better?" How I usually answer is this: The quicker we realize that it is not going to be what it was, the quicker we will be able to embrace the "New Normal."

I've seen it starting to happen. We are still in what would be considered a down economy yet we have had a string of good days on Wall Street. Home sales are starting to go up though the prices of homes....are not. I think we are beginning to come to grips with the fact that "this is it and this is how it is going to be".

Realistic sellers are facing up to the harsh reality that they will not get the big payday they expected from the house they bought in the "boom" a couple years back. Smart buyers who were once hesitant are realizing that with the combination of increased home sales and rising interest rates it is time to get off the sidelines.

The $8000 tax credit for first time home buyers will not be around forever- in fact it is due to expire by the end of this year.

Just as many have looked back and beaten themselves up for purchasing a house a couple of years ago when the market was topping out, there may be a slew of others who might very soon regret letting the opportunity of lifetime- the ability to purchase their dream home in a market that is beginning to lift its way out- slip through their hands.