Don't let the rush and excitement of the holiday season make you careless in protecting your home from potential criminals. The holiday season is a time when busy people can become careless and vulnerable to theft and other holiday crime. The following tips from the Los Angeles Police Department Crime Prevention Section can help you be more careful, prepared and aware during the holiday season.

- Be extra cautious about locking doors and windows when you leave the house, even for a few minutes.

- When leaving home for an extended time, have a neighbor or family member watch your house and pick up your newspapers and mail.

- Indoor and outdoor lights should be on an automatic timer.

- Leave a radio or television on so the house looks and sounds occupied.

- Large displays of holiday gifts should not be visible through the windows and doors of your home.

- When setting up a Christmas tree or other holiday display, make sure doors and passageways are clear inside your home.

- Be sure your Christmas tree (Or Hanukkah bush) is mounted on a sturdy base so children, elderly persons or family pets cannot pull it over on themselves.

- If you use lights on your tree ensure the wiring is not damaged or frayed. Frayed or damaged wiring can cause a fire.

- Place your Christmas tree in water or wet sand to keep it green.

- Never place wrapping paper in your fireplace.

Filed Under

holidays,

home protection

|

1 Comment

![]()

Someone lives in their house many years and decides it is time to sell. But before they do they feel the need to add granite to the kitchen, or add a pool, or some other big ticket remodel item. Why?

Well according to this article from CNN Money, this expense is most likely not the way to go because it will rarely return any kind of investment for a seller. A Realtor worth anything would not advise you to take this kind of project on because in many cases you are trying to "predict" what a potential buyer may want. And in many cases, you would be wrong.

Now take the example of a high ticket granite kitchen update. First off, a seller may be making a bunch of incorrect assumptions. Granite isn't the "only game in town" as far as counter surfaces are concerned. Is everyone a chef? Maybe a potential buyer has no interest in a high end kitchen and does not want to feel like he is paying a premium for one that has recently been installed. There are all kind of buyers out there- some who want "turn key" homes, others who want to feel they are getting a good deal and enjoy "fixer-uppers".

Oh, and by the way, what are the chances that the seller is going to pick the granite color the buyer has his/her heart set on.....?

Wouldn't a credit be a smarter way to go if a granite kitchen became a negotiating issue with a buyer? This way, the buyer can get exactly what they want.....and the seller doesn't have to go through the remodeling hassle playing "interior designer" or predict what a buyer wants.

Bottomw line- if a Realtor suggests a big remodel project before listing your home....get a second opinion from another Realtor.

If your Realtor suggests "don't spend your money on a remodel project to prepare your home for sale" -listen up and be happy!

He probably just saved you a lot of money.

Filed Under

listings,

remodel,

sellers,

sellers strategies

|

Leave a Comment

![]()

Why are these websites so inaccurate? The MSN article explains some of this well- but an automated valuation site usually doesn't take "location", into account. And what about upgrades? Do you think an automated site will know that you just put granite counter tops in your kitchen? The answer is no...and an upgrade like this would certainly raise the value of your property.

So you may be asking yourself....do I need to spend $350 (the basic rate for an appraisal) prior to listing my home? My answer is probably not. First off, there are hundreds of appraisers out there in the Orlando area and predicting what is in the mind of a particular appraiser that may be assigned to evaluate your home after executed contract is next to impossible. What you need is a Realtor who has a track record of pricing his homes competitively, accurately....and aggressively. If you are listing, you should definitely ask your Realtor how he/she is determining the value of your home.....a good Realtor will use a number of different methods. Most importantly, you should ask your Realtor what he/she does when and if a buyer puts a contract in on your home, and it comes up short on appraisal. How does he/she present the "case" to the appraiser? Many Realtors simply do not do this at all unfortunately.

The bottom line- These online sites do have a purpose. When I list a property, I want to know what these valuation sites say about the home.....because this is what many prospective buyers look at when they are evaluating a home purchase. Hey when I am putting an offer in for a buyer I will use these sites to try to negotiate the best possible price for my buyer. But as a sellers agent, a good Realtor should be able to make a "case" for his listed property for future discussions with possibly buyers and appraisers who might look at some of these sites.

I do not dismiss online home evaluation sites because buyers (in many cases) are using them to their advantage to negotiate a lower price for homes I have listed. Instead, I am very aware of how these sites have my listed homes valued.....because I believe it is better to "know thy enemy".

Filed Under

appraisal,

Articles by Michael Gonick,

buyers,

market value,

property values

|

Leave a Comment

![]()

I dissuade my sellers from having me present verbal offers to them. On our Coldwell Banker listing agreements a seller must "check" to have these offers presented. I say "don't check" even though a seller may find it tempting to do so.

First off, a verbal offer is not binding in any way shape or form. So why have it presented? Second, usually a verbal offer is basically a "drive by" who barks out a price with absolutely no conditions attached. A verbal offer can look one way, but it can turn out to something different with many details omitted. Examples- will there be a home inspection? Is this a cash deal? Closing date?

Third, writing up an offer takes time and effort. If someone from the buyer's side doesn't want to take the time to put together an offer for an important investment like a home purchase...how serious are they? When I am representing a buyer I will always write up my offer on behalf of my client because I want the seller to know that we mean business....even if the offer price is way off the list price.

Finally, a verbal offer is way too murky. It can result in a game of "he said/she said" that will lead to frustration and end up going no where.

So listen to the "King" (Elvis that is)..... because......talk is cheap. :)

Filed Under

Articles by Michael Gonick,

sellers,

sellers strategy,

Tips

|

Leave a Comment

![]()

Well for the most part, as with the other areas of Orlando we have reviewed recently, Colonialtown and the rest of zip code 32803 are showing positive signs that real estate trends are moving in the right direction. Sold properties are up 47% from last year, and homes pending are up 89% over the same period. With June being the final month to close on properties utilizing the $8,000 tax credit, as well as the continuation of lower interest rates, buyers who may have been sitting on the fence seem to making their move.

Any questions, or if I can be of any assistance in buying or selling real estate please do not hesitate to get in touch with me.

Filed Under

colonialtown,

orlando real estate,

trends

|

Leave a Comment

![]()

Looks like a promising trend in the College Park area as homes for sale are at the lowest level since we started keeping these trending reports back in April of 2009. At the same time both homes sold and pended are up compared to a month ago, a year ago and 15 months ago. Below you will see that although the "for sale" prices for single family homes in College Park are staying consistent, the "Sold at" prices are creeping up (+15% a year ago). As I have said in previous posts, the home buyers credit has something to do with this...but consistent lower interest rates are also a big factor- thus a window of opportunity perhaps for those who are thinking about listing in zip 32804.

Make sense? Questions? As always, if I can be of assistance to you do not hesitate to contact me at michael@michaelgonick.com.

Filed Under

College Park,

mortgage rates,

trends,

Winter Park. orlando trends

|

Leave a Comment

![]()

This article from ABC News which points out that a one point decline of interest rate can represent a $200 savings on a mortgage payment for a $400,000 home. This is equally good news for sellers if you think about it- there will be greater demand for homes as buyers try to take advantage of these low rates. Questions? Give a call or drop a line.

Filed Under

buyers,

mortgage rates,

orlando real estate,

sellers,

trends

|

Leave a Comment

![]()

I was going to write about this but the Orlando Sentinel took the words right out of my mouth. Read the full article here and get in touch with questions... I can explain why I have units in downtown Orlando buildings going under contract for clients now, and why things are picking up in our condo market.

Filed Under

condominium,

downtown,

Orlando,

trends

|

Leave a Comment

![]()

- Properties SOLD is 91% above 15 months ago, and 15% above a year ago. Comparatively to last month, sales are down 25% (which most likely due to the tax credit deadline).

- What looks promising is the PENDING sales data ...which continues an up trend (up 26%) compared to last month despite the expiration of the buyer's tax credit.

Filed Under

32801,

32806,

Delaney Park,

Lake Davis/Greenwood,

Lake Eola,

Lake Lawsona,

Thornton Park,

trends

|

Leave a Comment

![]()

Below is a link to an article from the Orlando Business Journal. Home sales rose 28% in June. Not a surprise to me.

As I have been saying for a couple of months now, certain zip codes (32801, 32806) and neighborhoods (Lake Davis/Greenwood, Delaney Park, Thornton Park, ) remain very tight as far as inventory is concerned. Areas downtown are bouncing back quicker than other areas- for example Winter Park. Yet many downtown Realtors are not doing their homework and continue to price homes BELOW market value...and they are selling fast. Maybe too fast for some sellers. This really isn't very good for property values. Of course this has been a tremendous opportunity for the buyers I am working with. But buyers beware, it is supply and demand. As the inventory tightens in hot areas, your choices may become limited particularly with the low interest rates we have at the moment.

I have set u charts on the side of my blog that pin points specific neighborhoods so you can see the relationship between inventory and list price in your own backyard. These charts update automatically. If you are considering selling your home...make sure you know the value in today's market. Make sure there is strategy to market it properly. Use a Realtor who is a specialist in your neighborhood and has a proven track record of buying and selling in your area. Do not sell yourself short! Call me if you have questions or if you want to know the true value of your home....today.

Here is the article from the Orlando Business Journal

I ran into one of my favorite "client couples" yesterday evening as I took a stroll around Lake Davis. These two are extremely savvy and have made great real estate decisions in my humble opinion as long as I have known them and worked with them. From time to time they will find a property and ask my opinion and whether or not it is the right time to buy and/or sell their existing home. I believe that if I am doing my job correctly, and want to be their "Realtor for Life", I have the responsibility to be 100% honest in all cases....even if my thoughts are not something they want to hear :). I try to be "objective" and lay out the facts as best as I can for each circumstance. This particular couple I ran into last night takes the time to weigh pros and cons, really listens to feedback from myself as well as their lender. I am fortunate to say that in our history of buying and selling transactions I do not think they have had a "dud" yet.

So it got me thinking, how can I help you decide whether or not it is the right time to buy or sell real estate in Central Florida right now? Of course, every situation is different and needs to be handled individually. But some general thoughts have come to my mind.

First off, let's think back to a couple of years ago...and the initial emotional reaction that many had when the real estate market took it's mighty tumble. Here is my analogy:

Have you ever seen a baby right after a huge chewing gum bubble pops on his face? A multitude in every single place, eyes wide, mouth in an "O" - fairly reminiscent of the real estate industry when its personal bubble popped. Homeowners panicked and rushed in a frenzied attempt to sell their Orlando homes. Why? Well in many cases there just wasn't what I considered to be a compelling reason other than "OMG I made a bad decision and I have to sell!". But did you make a bad decision?

All of a sudden a "dream home" became an unwanted "step child" of homeownership, the real estate market grew to become glutted, leading to lower sales prices. Two years later, some owners are still trying to sell their Orlando homes, still panicking, and still fearful about what the future will bring.

Stop.

Take a deep breath.

Stop worrying for a second and ask yourself… Why am I selling?

Of course, there are good reasons to sell:

- If you are able to sell your home and get a decent price, you instantly have the opportunity to be a buyer in a buyer's market....and reap the benefits which can be substantial.

- Certain zip codes (For example here in Orlando 32801 and 32806 as well as others) are "hot" right now and you might be able to do very well by selling.

- A house has become hard to afford.

- Some are getting older and have to move someplace that doesn't take as much maintenance.

- You have to relocate for a job.

However there are a lot of not-so-good reasons to sell:

- You've read a lot about people who have been unable to sell their homes that you turned alarmed and put yours available on the market "just in case" you wish to sell it later.

- You're simply uninterested in your home. If that's the case, maybe all you actually need to do is replace or redecorate your home to make it sparkle again.

- You want to throw your house on the market just to see what you can get for it (as unrealistic as it might be).

It may appear strange for a real estate agent to appear to be speaking in opposition to selling Orlando homes.... I really am not. There is a right time to list a home- and it may be the right time for you now. Many of my collegues are inundated with listings they cannot sell and I am not at this point- simply because my first motivation is always doing what's best for my clients, together with giving them the best advice I can.

So, I ask you to think about both the pros and cons of selling right now.

I will remind you that even if your home has lost some value, there are many ways that your home continues to be very "valuable":

- Building credit - Home ownership is still a good way to construct credit. With good credit you can borrow for different major bills, such as a new car.

- Building equity - The typical home equity for the U.S. is approximately $38,000. When you contemplate how a lot your home costs, that won't appear to be much. Nevertheless, when you are ready to sell, that equity will be there to put toward your next home purchase or your retirement savings.

- Saving cash on taxes - Owning a home offers a number of tax benefits. For most Americans, the biggest benefit is deducting the annual interest paid on a mortgage- and here in Florida we have our homestead exemption of course.

- Living well - There's a reason why home ownership is still referred to as the American Dream. It simply feels good to reside in a home you love. You have the control andcan decorate any way you want. It is a home that is your very own.

Hey if you think it's a "Dogs Life" for dogs in the "City Beautiful" then you are barking up the wrong tree. According to this list courtesy of dogfriendly.com, in 2010 Orlando ranks #7 for vacationing pooches. San Diego was #1 by the way. So hats off Orlando....we prevailed although there was definitely "ruff" competition. :)

A total of 16,745 single-family existing homes sold statewide last month compared to 14,172 homes sold in May 2009 (see chart above). The statewide existing-home median price of $140,400 in May was slightly higher – by $300 – than April’s statewide existing-home median price of $140,100. It marks the third month in a row that the statewide existing-home median price has increased over the previous month’s median.”

Filed Under

economy,

Florida,

Florida markets,

home sales,

market value,

Winter Park. orlando trends

|

Leave a Comment

![]()

4.69% for a fixed 30 year mortgage? Who would have thought it possible. But then again, are we at the lowest point? Is this the time to refinance? Who are the winners and the losers? Warnings?

I watched a bunch of reports this morning and I think this one from CBS News does a good, concise job of summing it all up and making it easy to understand the pros and cons.

Hope it helps.... :)

Filed Under

market value,

mortgage rates,

mortgages,

property values

|

Leave a Comment

![]()

According to the OBJ, Florida scored highest for its top marginal personal income tax rate, state minimum wage and its right-to-work status. Good news for us!

Filed Under

economy,

Florida,

Florida markets,

market value,

markets,

Orlando Business Journal,

predictions,

trends

|

Leave a Comment

![]()

If you look at the right sidebar of this blog ORLANDO REAL ESTATE MATTERS you will see boxes that display listing inventory and pricing trends for most of the neighborhoods in Downtown Orlando as well as Winter Park. If you have questions on how to interpret this information, or if there is a specific neighborhood that you would like information for that is not listed....just let me know and you shall have it :)

Wow.... I count at least two puns in that headline:)

Seriously, according to CNN, you really have to weigh all of your options before you turn in the keys and walk away from a loan commitment you have with a bank for a property you own. It can be many years (more than you might think) before your credit score is restored and you have the opportunity to borrow money. So before you pull the plug, you should consult with someone who might offer some other suggestions and possible solutions. Someone like your Realtor for starters. In the past year I have worked with a number of homeowners thinking they had only two possible paths- short sale or foreclosure. In every single case, I have sold their homes without having to resort to either of these options....and the sellers' credit was not impacted at all.

If I can be of any service, or if you have any questions...please do not hesitate to get in touch with me.

Filed Under

credit score,

foreclosures,

sellers,

short sales,

tax credit

|

1 Comment

![]()

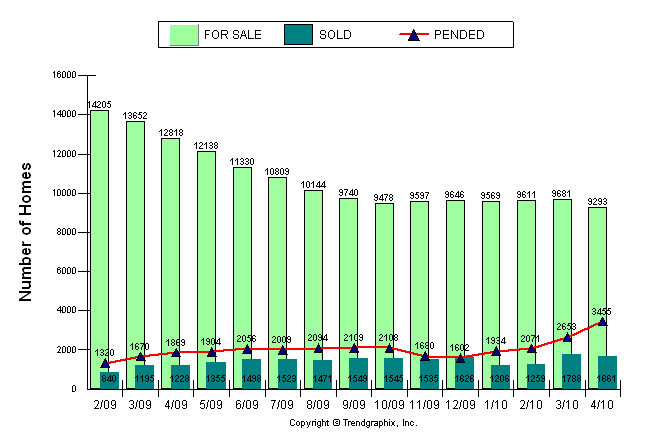

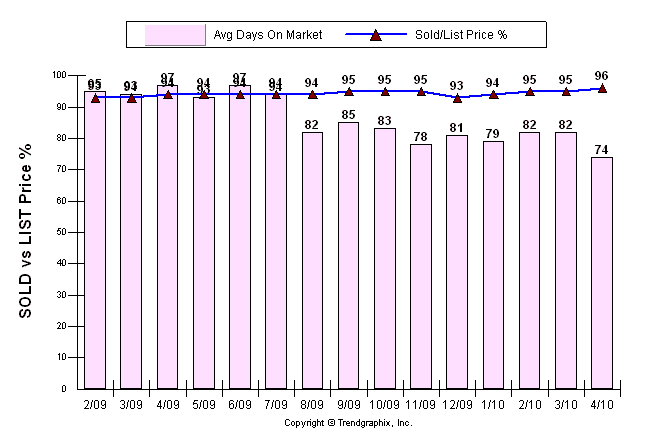

In a nutshell, from the first graph you will note that the amount of pending sales in Orange County increased significantly in April (in part to the deadline for the $8000 tax credit), homes on the market continue the declining trend, and actual sales remained basically flat though up significantly from last year.

In the second graph you will note that the "days on the market" number for homes in Orange County is the lowest in over a year, while sold price averages 96% of list price.

For more information about what these numbers might mean to you, or if you would like to see data on any other counties in Central Florida, please get in touch with me.

Filed Under

buyers,

Florida markets,

orange county,

sellers,

trends

|

Leave a Comment

![]()

This article from this morning's Orlando Sentinel...... still sitting on the fence?

It is the combination of lowest pricing in years AND wages and earnings - which have remained stable.

Give us a call if you have any questions.

Filed Under

buyers,

Orlando Sentinel,

trends

|

2 Comments

![]()

Earth day is one day of the year, but with just a little effort on your behalf, you will find that you can recycle just about everything that you use on a daily basis. Help Mother Earth, set an example for your friends and family, and get started today!

Plastics

-Refer to the "triangle" symbol usually on the bottom of the container

# 1s and 2s - go to your curbside recycling bin

# 5s - Whole Foods & Aveda Salons (items such as plastic tops like those found on shampoo bottles, water bottles, mayonnaise jars, etc. - and some sour cream and other containers - all of which are not supposed to be included in your recycling bin. The plastic tops cause the death of millions of birds worldwide every year and there is now the Great Pacific Garbage Patch floating in the ocean and twice the size of the State of Texas.)

Whole Foods' recycling program for # 5s is called "Gimme 5"

Metal tops (beer bottles, soup cans, etc.)-

City of Orlando collection sites at Loch Haven Park, Barldwin Park, Lake Fairview Park, ... which also take paper products

Hazardous & Electronic Waste - (batteries, paint, pesticides, herbicides, chlorine, computers, microwave ovens, etc.)

Orange County Solid Waste sties - McLeod Road Transfer Station and Orange County Landfill on Young Pine Road

Junk mail, magazines, newspapers, copier paper, telephone books, & cardboard- Orange County Public Schools recycle these as a means of raising funds.

Styrofoam (packing, egg cartons, to-go boxes, meat & vegetable trays, etc.)- Central Florida Zoo

Box Tops for Education, Labels For Education, Pop Tops For Education, and Printer Cartridges -

Most Public Schools

Aluminum tennis can tops (or similar)-

Ronald McDonald House

Packaging (bubble wrap, "peanuts", etc.)-

UPS Stores & Mailboxes Etc.

Mulch bags, -

reuse for yard waste

Cloth (sheets, clothes, etc.)-

reuse as a weed suppressant

Plastic (bags, wraps, covering, etc.)-

Publix Supermarkets

Brita Water Filters-

Whole Foods

Rubber or Plastic Corks-

ABC Fine Wines & Spirits

Athletic Shoes-

Nike's Reuse-A-Shoe Program

Tennis Balls-

United Cerebral Palsy OR leave keep them together and I can pick up from you and donate them to Jeff Horn's Genesis Community Program"

Used Postage Stamps-

Habitat for Humanity of Lake County

Dry Cleaning-

The consensus seems to be that Acme Dry Cleaners is the most green. You can read a review and get the link to their website to review their "green" credentials at Acme Dry Cleaners They have locations Downtown and College Park, and you can arrange home pickup and delivery.

All of this great information is courtesy of my tennis pro and supreme "recycler"- Jeff Horn.

Please check out his website at Jeff Horn

P.S....if you contact Acme, please use Jeff Horn's name! They have a referral program and you can get started with it as well once you set up an account with them.

Earth Day is over...but is your commitment to recycling solid? It really isn't that hard when you think about it. A good idea is to just keep a different bag for each recycle destination and plan on doing a drop each quarter, or 1/2 year. It will probably take minimal time to do this and you will be helping "Mother Earth" in a big way.. Set an example for your friends, family, clients and business associates.

Have a great "green" day, and call me with any questions.

Michael Gonick Realtor

Coldwell Banker Residential Real Estate

407 383 2563

www.orlandorealestatematters.com

Filed Under

Articles by Michael Gonick,

Green,

Orlando,

recycling

|

Leave a Comment

![]()

This article from CBS News does a great job at summarizing the pros and cons of why it may be the right time to buy a home. CLICK HERE.

Filed Under

market value,

Orlando,

predictions

|

Leave a Comment

![]()

This article from Forbes Magazine. Earth day is tomorrow, but why wait when you can get started today.

Going Green Cheaply and Easily

Filed Under

Green,

home improvements,

Tips

|

Leave a Comment

![]()

...you might want to take a look at the condominium complex I live in- Fairwind Shores in Ormond Beach, Florida. Ormond is on the east coast of Florida just north of Daytona Beach, and an hour north of Cape Canaveral. I had always dreamed of having a place at the beach so after I moved to Florida I started my search and decided on Ormond because of it's proximity to Orlando (70 minutes), the strict zoning restrictions preventing high rises in the part of the beach I live in, the beach itself which is pretty much isolated....and the town which I love. Downtown is filled with quaint shops, and some of the best restaurants in the state.

After I decided that Ormond was right for me, I looked at every condominium building in town and there was no question that Fairwind Shores was the best for me. Basically, every unit is a corner unit, our buidings have lobbies, we only allow long term renters (over 30 days), and besides the pools and private access to the beach....we have our own tennis court!

I have yet to rent mine out, but those that do usually do not have problems finding renters. Many have the same "snowbirds" each year, some rent out just for a couple of months, some for the majority of the year. I would say more than 1/2 the residents live there full time.

The units themselves are each approximately 1200 square feet, 2 bedroom, 2 bath with separate laundry room in each. Just about everyone has oceanfront views from the bedroom, living room and kitchen.

Anyway, I bring this up because we rarely have units available for sale, but now we have some great deals- some units below $200,000! If you are interested let me know and I can tell you more and can be of service if you decide that Fairwind Shores is right for you.

Here is our website www,.fairwindshores.com.

Filed Under

condominium,

investment,

investment property,

ormond beach,

vacation,

Volusia County

|

Leave a Comment

![]()

Playground Music and Arts Festival Sunday 10am till 4pm Sounds fun for children and the children in all of us. Here is some more info---- Playground Music and Arts Festival

Filed Under

Lake Eola,

out and about in Orlando

|

Leave a Comment

![]()

From the "home office" you will note big jumps in sales, homes pending, and drop in homes on the market compared to a year ago and last month.

March 2010 Market Trends Report- Orange County

If you have any questions, or need information on any other counties in Florida, feel free to contact me.

1. Of course I look familiar. I was here just last week cleaning your carpets, painting your shutters, or delivering your new refrigerator.

2. Hey, thanks for letting me use the bathroom when I was working in your yard last week. While I was in there, I unlatched the back window to make my return a little easier.

3. Love those flowers. That tells me you have taste... and taste means there are nice things inside. Those yard toys your kids leave out always make me wonder what type of gaming system they have.

4. Yes, I really do look for newspapers piled up on the driveway. And I might leave a pizza flier in your front door to see how long it takes you to remove it..

5. If it snows while you're out of town, get a neighbor to create car and foot tracks into the house. Virgin drifts in the driveway are a dead giveaway.

6. If decorative glass is part of your front entrance, don't let your alarm company install the control pad where I can see if it's set. That makes it too easy.

7. A good security company alarms the window over the sink. And the windows on the second floor, which often access the master bedroom - and your jewelry. It's not a bad idea to put motion detectors up there too.

8. It's raining, you're fumbling with your umbrella, and you forget to lock your door - understandable. But understand this: I don't take a day off because of bad weather.

9. I always knock first. If you answer, I'll ask for directions somewhere or offer to clean your gutters. (Don't take me up on it.)

10. Do you really think I won't look in your sock drawer? I always check dresser drawers, the bedside table, and the medicine cabinet.

11. Here's a helpful hint: I almost never go into kids' rooms.

12. You're right: I won't have enough time to break into that safe where you keep your valuables. But if it's not bolted down, I'll take it with me.

13. A loud TV or radio can be a better deterrent than the best alarm system . If you're reluctant to leave your TV on while you're out of town, you can buy a $35 device that works on a timer and simulates the flickering glow of a real television. (Find it at http://www.faketv.com/)

14. Sometimes, I carry a clipboard. Sometimes, I dress like a lawn guy and carry a rake. I do my best to never, ever look like a crook.

Filed Under

home improvements,

home protection,

safety

|

Leave a Comment

![]()

Courtesy of CNN and Money Magazine.... this is a nifty little page that lets you find out which markets across America have had the biggest price drops and offer the best opportunities depending based on what criteria is important to you.

A couple of facts here:

Both Lake Mary and Oviedo made the top 100 list of "Best Small Towns to Live".

Orlando's 9% depreciation seems to indicate that it is still a good place to find bargains (as are many cities in Florida).

Click below and play around with the page....very interesting....

Best (and worst) Places to Buy A Home NOW

Filed Under

economy,

Florida,

Florida markets,

investment,

Lake Mary,

market value,

markets,

Orlando,

Oviedo,

property values,

relocation

|

Leave a Comment

![]()

If you are visiting us for spring break, if you are visiting us for the day, or if you are one of us living here in the "city beautiful" you might not realize what we have around us that is fun and FREE.

We are just DISNEY here in Orlando you know.

These ideas courtesy of the "Traveling Mom".

Any other suggestions for free things to do in Orlando?

Filed Under

downtown,

Orlando,

relocation,

things to do,

visitors

|

Leave a Comment

![]()

Do I show favoritism? Well it is true that I live in the neighborhood, and I was the President of the Lake Davis/Greenwood Neighborhood Association....

So I was pleased to see this nice write up on 903 Mills Market in the online "Visit South" guide. Bravo!

Filed Under

downtown,

Lake Davis/Greenwood,

neighborhoods,

restaurants

|

Leave a Comment

![]()

I figure the day after my 50th birthday would be the appropriate time to recognize that our very own Thornton Park has been named one of the magazine's best "Old House" neighborhoods of 2010.

Old is in!

Full article from "This Old House" magazine below.

Thornton Park, Orlando, Florida | Best Old House Neighborhoods 2010: the South | Photos | Home & Real Estate | This Old House

Filed Under

central florida,

downtown,

Orlando,

Thornton Park

|

Leave a Comment

![]()

As temperatures begin to warm, termites make their way back to our sunny state. According to the Florida Realtors Association there are some preventative measures that you can take to protect your property:

• Remove wood piles and other cellulose sources from under and next to homes.

• Have an annual inspection by a licensed professional pest control company.

• Direct water sources, such as air conditioner drip lines and roof downspouts, away from the structure foundation.

• When purchasing a home, carefully check its termite protection history.

• Obtain a termite protection contract and renew it annually.

Make sure you read your termite bond contract- not all are created equal.

You can read the entire article here and feel free to get in touch with me if you have any questions.

Filed Under

central florida,

home improvements,

preparation for sale,

property values,

termites

|

Leave a Comment

![]()

Take a look here and you will see the "active" inventory of homes for sale in Orange/Seminole counties, as well as the total 6 counties of Central Florida. This is courtesy of my very smart, very analytical Broker Lois Ralston from our Coldwell Banker Winter Park office. All weekly numbers are in comparison to the highest level of homes that were on the market in November of 2008 in Orange/Seminole. In a nutshell, there were over 20,000 homes in these two counties back then, and now just over 13,000 homes the week of 2/22/10. Basically inventory has dropped about 35%. It has stayed consistent for months now.

Whether you are buying your first home, or up-sizing or downsizing, here are twelve easy steps to buying a home- and how I can help you along the way.

-

Check Your Credit

Get with your mortgage person/bank (I have a list of brokers I deal with) , and have them check your credit before the process begins. Ask them to go over your finances to determine what kind of payments you can afford. Have them give you a good faith estimate. Have them include all the taxes and insurance on the NEW purchase price. Ask for a pre-qualification letter which many sellers request you have before you look at their homes.

-

Find a Good Realtor

When I work with a new client I show them my results and testimonials. Beware! Your friends and family may have someone in mind, but you want a full time agent who has experience, and who will be there for you when you need them to be. Moving to a new city? Ask your former Realtor to help you find a new Realtor in your new town. This is called a referral, and I would be more than happy to do it for anyone moving out of town. Remember, there should be no cost at all for you to have a buyer's agent representing you. That cost is picked up by the seller so why shouldn't you utilize a professional like me to help you with your search?

-

Make a List

Start your search by sitting down and determining your daily lifestyle. I ask my new clients to make a list. For example: Do you work from home? Like to cook? Need a wall for a gigantic flat screen TV? Is a pool a must? Write it down – Think of everything you would want to be in your new home. If you have kids let them be a part of the process- make it a family project! Start with everything you can think of that is important to you (you can always cut down the list later), and place items in order of importance. This process will help me help you.

- Start the MLS Search

Now this part really depends on how involved you want to be in the process. You can begin looking at homes on the internet, or leave the work to me. Either way, you will become educated on what is available in your chosen market area, and what is actually going on in the market. Pay close attention to how long a home is on the market, which ones sell, and for how much.

-

Look at as Many Homes as You Feel Comfortable

Look until you find the right one for you. A good Realtor should never "sell" you on a home. The Realtor is there to present properties. There may be something quirky about a house that you like...or that you cannot live with. Don't rush it. After all, if I am your Realtor I am going to want you to be happy because I want you to refer me to everybody you know.

Get to Know the Market

When you have found one or two homes you really like, sit down with your Realtor and get the facts. I like to double check a number of small items that sometimes others forget to do. For example, does the square footage of the home listed in the county records match what the seller is representing the sq ft. to be? Make sure you have a good understanding of what homes have been selling for in the area, how many days have they been on the market, and what were the features from one home to the next. Get to know the market.

-

Make the Offer

Some home prices have a "cushion" built in so that a spirited negotiation can take place between buyer and seller. Others are priced very close to what the seller wants (or needs) to be able to close on the deal. Don't assume that each offer should be a set percentage off the asking price. When I am preparing an offer for a client, I look at a number of things including how long the home has been on the market, what does the seller owe on the property still, what homes have been selling for in the market etc. I am a tough negotiator but I always try to remember that everyone in the transaction feels like they win. There is no reason to get emotional. Hopefully, you and the seller will come to terms with a price that works....if not, there are other homes. If you feel strongly about a certain property, make sure you are not so rigid that you walk away over something that might not be that big of a deal in the long run. Put your faith in your Realtor... he should be a pro who specializes in bringing buyer and seller together with terms they can both agree on.

-

Home Inspection

Once your offer is accepted have a certified home inspection done even if you are buying a property "as is". The inspector is trained to see past the paint and frills. Regardless of the terms, Florida law states that a buyer can walk away from the deal if there is anything wrong in the home based on the results of the home inspection. I like my buyers to feel comfortable going into the final stretches of the process and a home inspection usually does the trick.

-

Appraisal and Final Paperwork

Your lender will order any surveys or appraisals that you will need. At this point the lending officer will be looking over your file to determine if everything is in order. Since an appraiser can be assigned from anywhere in the state to determine the value of the home you are purchasing, I always always always meet with the appraiser personally....whether I represent the buyer, the seller, or both...to make sure they understand the value of the property. The sooner you get a commitment from the bank the better off you are.

-

Week Before Closing

Be sure to lock in your home owners insurance- you cannot close on any property without insurance in place. I have a list of agents that I work with that I can provide for my clients. Also, call to have utilities turned on or transferred into your name. I give a list of all service providers and their phone numbers to my clients so they can get in touch regarding power, cable, internet, gas (if necessary) etc.

-

Day of Closing

I insist that we have a final walk-thru on the day of closing. We want to make sure that the home is in the state it was at the inspection, and that everything is in order. At this point I make sure the seller has provided us with all receipts of the work that we agreed in writing previously has been done to buyer's satisfaction. Also, might sound strange...but we want to make sure the sellers have moved out before you move in! Sometimes you won’t know the exact amount of money to bring to the closing until the morning of the closing. We will check with your lender for that amount so you can have a cashiers check drawn at your bank. There is no point in doing this earlier than the day of closing because that final figure can change (even if it is ever so slightly) up until the time of closing. Don’t panic, no one can do this without you there. By this time I have already reviewed your pre- HUD statement, making sure that you are not being over charged for anything and that everything looks in order. We want to avoid any "hiccups" when we get to the title company office. I make sure that I have all the keys, garage door openers, manuals, warranties, and service providers such as lawn care people, pet groomers etc. so that you are ready to start enjoying your new home from day one.

-

After the Closing

Are you smiling? You should be. You have purchased the home of your dreams. If I can be if assistance, do not hesitate to call me with any questions whatsoever. If buying this home was a good experience please recommend me to all your friends and family :)

Pricing Your Home Too High. Why it Can be "Deadly" to the Selling Process of Your Home.

"I Want to List it High Because I Know Someone Will Offer Less"

When a seller interviews a real estate agent it's easy for them to get caught up in the excitement of choosing a sales price. If they can get more money for the home, it means more financial opportunities for the homeowner. Maybe it means they can afford to buy a larger, more expensive home, pay off some bills or take a vacation. Unfortunately, uninformed sellers often choose the listing agent who tells them they will list it at the highest list price. This is, by far, the worst mistake a seller can make.

Establishing Value

The reality is that it doesn't matter how much money you think your home is worth. The only person whose opinion really matters is the buyer who is going to make offer, and of course, the appraiser. Pricing a house is part science and part art. It involves comparing similar houses in similar communities, making the necessary adjustments for the differences between them, charting market movements and measuring the amount of housing inventory, all of this in an attempt to help determine a range of value. This is the same method appraisers use to evaluates a house. No two appraisals are exactly the same; they are however, generally close to one another. There is no hard and fast way to just stick a price on your home. If your Realtor doesn't present you with a thought out, well prepared CMA (Comparable Market Analysis) I would consider using someone else. It is a must have. If you feel that what you think you can get for your home is dramatically different from what your Realtor thinks, a good Realtor would suggest getting an independent third opinion from an established area Appraiser.

Is the Price Too Low?

Houses sell at a price a buyer is willing to pay and a seller is willing to take. If a house is priced too low the seller should expect to receive multiple offers and drive up the price up to the market value. There is not much danger in pricing a home under its actual value and your competition. The danger is in pricing it too high and haveing the house sit on the market for months.

How It Starts To Go Wrong

The seller of a home didn't interview her real estate agents. She pick the first agent off the Internet, or a friend, or someone else because, "He looked like a nice guy." The agent priced her house at $250k. After 90 days of sitting on the market, the listing expired.

It Continues To Go Wrong

The next agent she hired listed the house at $235k. Months passed and eventually she dropped the price to just under $220k, still no offers. A few people looked at the house, but no serious buyers came forward.

More Than a Year Later

By the time she hired the last agent list her house, the seller had grown exhausted and weary. It was now more than 12 months later. The seller and her agent then priced the home at $195k and it sold very quickly. The sad part is that the comparable sales in the neighborhood fully justified a price of $220k, but the home had been on the market for too long at the wrong price, and now the market had slowed.

Protect Yourself

The question is how much money an expired listings can cost a seller. The financial losses often exceed the extra mortgage payments and goes way beyond the cost of trying to keep you home spotless during the listing period. It affects the value that a buyer ultimately chooses to pay because it is no longer a "fresh" listing. It's now stale, dated, a home that was overpriced for too long. Don't let this happen to you. Don't be that seller of an expired listing. Be sure to hire a professional Realtor who will help you price your home correctly from the beginning. Your Realtor should have access to powerful tools that can help you determine the best list price for you house.

If you are thinking about buyer or selling a home in the Central Florida area or beyond, do not hesitate to get in touch with me and I will give you my expert opinion on your situation--- with no commitment and free of charge.

Filed Under

listings,

sellers

|

Leave a Comment

![]()

I was at a listing presentation last week in Winter Park and was asked to explain the difference between the two to my seller. He said it was helpful to him, so I wanted to pass it on to you....

The appraised value of a property is a professional estimate of a property’s market value. It’s based on the recent sales of similar properties, square footage, location, construction quality, and more. An appraisal varies in cost depending on the price and size of the home. Most lenders require appraisals as part of the loan application process.

But don’t confuse the appraisal with market value. The appraised value is a certified appraiser’s opinion of the worth of a home at a given point in time. And it should give you a pretty good idea what your home will sell for. Ultimately, though, your home’s market value is the price a buyer is willing to pay for it. Having your home professionally appraised before putting it on the market is one way to help you and your Realtor determine a fair asking price. There are other methods of determining the value of your home, including a comparative market analysis (CMA) which I can put together for no cost. A CMA compiles information and sales prices from homes similar to yours from your neighborhood that have sold recently. If you are considering putting your home on the market, or if you are interested in knowing what the value is to make a determination of what your next step might be...drop me a line and I can help you. No cost, no obligation.

Whether it be a CMA, an appraisal, or both, we will be able to price your home according to objective measures rather than a gut feeling or a number plucked from the air.

Filed Under

appraisal,

Articles by Michael Gonick,

CMA,

listings,

market value

|

Leave a Comment

![]()

I just don't think it is fair.

San Jose PLUS Palo Alto PLUS Santa Clara = Number 24.

And Chicago got to add Evanston to take it to #4.

Surely if we were allowed to add Daytona Beach to Orlando we would be able to jump up a notch or two. I hear they have some great high school football in Daytona.

Here is the top 50 courtesy of The Sporting News.

1. Pittsburgh

2. Philadelphia

3. Boston

4. Chicago + Evanston

5. Los Angeles

6. New York

7. Phoenix + Tempe

8. Miami

9. Dallas-Fort Worth

10. Detroit + Ann Arbor + Ypsilanti

11. Houston

12. Nashville

13. Atlanta

14. Washington

15. Tampa-St. Petersburg

16. Minneapolis-St. Paul

17. Raleigh + Durham + Chapel Hill, N.C.

18. Denver + Boulder

19. Salt Lake City + Provo

20. Indianapolis

21. Anaheim

22. Cleveland

23. Charlotte

24. San Jose + Palo Alto + Santa Clara

25. New Orleans

26. Milwaukee

27. Orlando

28. Baltimore

29. Cincinnati

30. St. Louis

31. San Diego

32. Portland

33. Oakland + Berkeley

34. Columbus

35. San Antonio

36. Toronto

37. Oklahoma City + Norman

38. Austin, Texas

39. Vancouver

40. Buffalo

41. Gainesville, Fla.

42. Calgary

43. Storrs, Conn.

44. East Lansing, Mich.

45. Montreal

46. San Francisco

47. Memphis

48. State College, Pa.

49. Kansas City

50. Jacksonville

House hunting? Be prepared with a pre-approved mortgage loan.

Many home buyers miss out on one of the most important steps in the home buying process. No matter what type of real estate market, a good Realtor will tell you that it is a good idea to be pre-approved for a mortgage loan before the house hunting begins.

A pre-approved mortgage loan is a lender's actual commitment to lend to the home buyer, with specifications on the exact loan amount. To become pre-approved, consumers must provide personal financial information, such as income, debts and assets, to an underwriter. After a home buyer applies for the loan, the lender will most likely approve the application with certain caveats. As the lender is committing to the loan amount and interest rate up front, the buyer knows they have their financing in place before begin shopping for a home. Advantages of having a pre-approved mortgage loan include:

Establishing an advantage in a competitive market. A pre-approval letter gives you an edge in a multi-offer situation. Sellers prefer working with potential buyers who are pre-approved; they do not want a deal to fall through because the purchaser cannot get sufficient financing. An offer with a mortgage pre-approval letter carries far more weight than an offer with only a pre-qualification letter or no letter at all. In fact, sellers often accept offers of lower dollar amounts from pre-approved buyers over buyers who have not been, despite higher offers. With pre-approval, the home sellers are more confident the deal will go smoothly.

Finding the best possible type of loan. Working with a mortgage agent before looking at houses would give you plenty of time to decide what category of mortgage product works best for your financial goals. Once you decide on the kind of loan you want and you are pre-approved for it, you then focus with your Realtor (pick me!) on finding your dream home.

Establishing the price range. Getting pre-approved for a mortgage enables you to determine, prior to house hunting, how much money you qualify for, thereby establishing a price range. You and your Realtor can then focus on looking at appropriate homes.

Seeking comfort with the loan amount. By taking the time to seek pre-approval, you select a comfortable loan amount. In many cases, buyers may qualify for mortgages that are more expensive than what they feel comfortable committing to for the long-term, merely because it works on paper. It is important for you to purchase a home you can afford.

I have a number of lenders that I have worked with successfully that I can put you in contact with if need be. Do not hesitate to get in touch with me about this...or anything else.

Happy New Year!