I would think that the idea of living on a beautiful Orlando lake close to restaurants, shopping, possibly work and everything else downtown would be appealing to many. Imagine your home as your vacation home- and being able to live the dream all year long? Not bad!

However not all lake front homes are created equal.

Not all Orlando lakes are created equal.

If you are in the market for a lake front home close to downtown Orlando Florida you may want to ask the following questions:

- Is the home truly "Lake Front"? There are many homes that are advertised as lake front and many of them are not. For example, a home that faces a lake is actually lake view if there is any sort of road between the house and the lake. The house might have spectacular views, but it is not true lake front property and will not be valued as such.

- What kind of lake is the home situated on? Basically, you have recreational lakes which allow skiing, and the rest that do not. From what I have seen lake homes on recreational lakes- which allow fishing, boating, skiing etc. can garner greater sales price cost per square foot than one equal in all ways (including location) but not situated on a recreational lakes. Furthermore, when I asked Kelly Kellogg, State Certified Residential Appraiser she said there was no comparison because "a skiable lake is not comparable to a small lake which is not skiable".

|

| 1225 Bryn Mawr St 32804 we have currently listed on "private" ski lake- Lake Silver |

My advice is to find out the answers to these questions if you are pursuing lake front property. If you have any questions, or would like to see our beautiful listing at 1225 Bryn Mawr in College Park please get in touch.

Filed Under

buyers,

lake front,

Lake Silver,

multi million dollar listings,

orlando real estate,

sellers

|

1 Comment

![]()

Someone lives in their house many years and decides it is time to sell. But before they do they feel the need to add granite to the kitchen, or add a pool, or some other big ticket remodel item. Why?

Well according to this article from CNN Money, this expense is most likely not the way to go because it will rarely return any kind of investment for a seller. A Realtor worth anything would not advise you to take this kind of project on because in many cases you are trying to "predict" what a potential buyer may want. And in many cases, you would be wrong.

Now take the example of a high ticket granite kitchen update. First off, a seller may be making a bunch of incorrect assumptions. Granite isn't the "only game in town" as far as counter surfaces are concerned. Is everyone a chef? Maybe a potential buyer has no interest in a high end kitchen and does not want to feel like he is paying a premium for one that has recently been installed. There are all kind of buyers out there- some who want "turn key" homes, others who want to feel they are getting a good deal and enjoy "fixer-uppers".

Oh, and by the way, what are the chances that the seller is going to pick the granite color the buyer has his/her heart set on.....?

Wouldn't a credit be a smarter way to go if a granite kitchen became a negotiating issue with a buyer? This way, the buyer can get exactly what they want.....and the seller doesn't have to go through the remodeling hassle playing "interior designer" or predict what a buyer wants.

Bottomw line- if a Realtor suggests a big remodel project before listing your home....get a second opinion from another Realtor.

If your Realtor suggests "don't spend your money on a remodel project to prepare your home for sale" -listen up and be happy!

He probably just saved you a lot of money.

Filed Under

listings,

remodel,

sellers,

sellers strategies

|

Leave a Comment

![]()

I dissuade my sellers from having me present verbal offers to them. On our Coldwell Banker listing agreements a seller must "check" to have these offers presented. I say "don't check" even though a seller may find it tempting to do so.

First off, a verbal offer is not binding in any way shape or form. So why have it presented? Second, usually a verbal offer is basically a "drive by" who barks out a price with absolutely no conditions attached. A verbal offer can look one way, but it can turn out to something different with many details omitted. Examples- will there be a home inspection? Is this a cash deal? Closing date?

Third, writing up an offer takes time and effort. If someone from the buyer's side doesn't want to take the time to put together an offer for an important investment like a home purchase...how serious are they? When I am representing a buyer I will always write up my offer on behalf of my client because I want the seller to know that we mean business....even if the offer price is way off the list price.

Finally, a verbal offer is way too murky. It can result in a game of "he said/she said" that will lead to frustration and end up going no where.

So listen to the "King" (Elvis that is)..... because......talk is cheap. :)

Filed Under

Articles by Michael Gonick,

sellers,

sellers strategy,

Tips

|

Leave a Comment

![]()

This article from ABC News which points out that a one point decline of interest rate can represent a $200 savings on a mortgage payment for a $400,000 home. This is equally good news for sellers if you think about it- there will be greater demand for homes as buyers try to take advantage of these low rates. Questions? Give a call or drop a line.

Filed Under

buyers,

mortgage rates,

orlando real estate,

sellers,

trends

|

Leave a Comment

![]()

Wow.... I count at least two puns in that headline:)

Seriously, according to CNN, you really have to weigh all of your options before you turn in the keys and walk away from a loan commitment you have with a bank for a property you own. It can be many years (more than you might think) before your credit score is restored and you have the opportunity to borrow money. So before you pull the plug, you should consult with someone who might offer some other suggestions and possible solutions. Someone like your Realtor for starters. In the past year I have worked with a number of homeowners thinking they had only two possible paths- short sale or foreclosure. In every single case, I have sold their homes without having to resort to either of these options....and the sellers' credit was not impacted at all.

If I can be of any service, or if you have any questions...please do not hesitate to get in touch with me.

Filed Under

credit score,

foreclosures,

sellers,

short sales,

tax credit

|

1 Comment

![]()

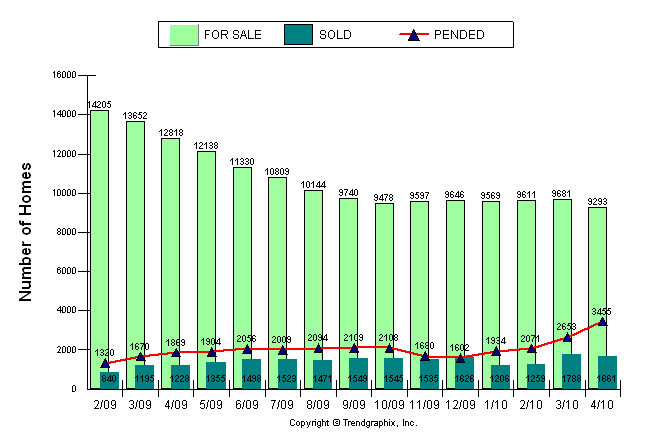

In a nutshell, from the first graph you will note that the amount of pending sales in Orange County increased significantly in April (in part to the deadline for the $8000 tax credit), homes on the market continue the declining trend, and actual sales remained basically flat though up significantly from last year.

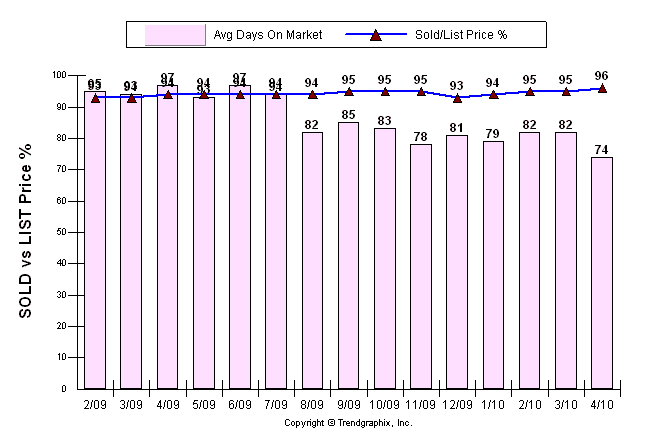

In the second graph you will note that the "days on the market" number for homes in Orange County is the lowest in over a year, while sold price averages 96% of list price.

For more information about what these numbers might mean to you, or if you would like to see data on any other counties in Central Florida, please get in touch with me.

Filed Under

buyers,

Florida markets,

orange county,

sellers,

trends

|

Leave a Comment

![]()

Pricing Your Home Too High. Why it Can be "Deadly" to the Selling Process of Your Home.

"I Want to List it High Because I Know Someone Will Offer Less"

When a seller interviews a real estate agent it's easy for them to get caught up in the excitement of choosing a sales price. If they can get more money for the home, it means more financial opportunities for the homeowner. Maybe it means they can afford to buy a larger, more expensive home, pay off some bills or take a vacation. Unfortunately, uninformed sellers often choose the listing agent who tells them they will list it at the highest list price. This is, by far, the worst mistake a seller can make.

Establishing Value

The reality is that it doesn't matter how much money you think your home is worth. The only person whose opinion really matters is the buyer who is going to make offer, and of course, the appraiser. Pricing a house is part science and part art. It involves comparing similar houses in similar communities, making the necessary adjustments for the differences between them, charting market movements and measuring the amount of housing inventory, all of this in an attempt to help determine a range of value. This is the same method appraisers use to evaluates a house. No two appraisals are exactly the same; they are however, generally close to one another. There is no hard and fast way to just stick a price on your home. If your Realtor doesn't present you with a thought out, well prepared CMA (Comparable Market Analysis) I would consider using someone else. It is a must have. If you feel that what you think you can get for your home is dramatically different from what your Realtor thinks, a good Realtor would suggest getting an independent third opinion from an established area Appraiser.

Is the Price Too Low?

Houses sell at a price a buyer is willing to pay and a seller is willing to take. If a house is priced too low the seller should expect to receive multiple offers and drive up the price up to the market value. There is not much danger in pricing a home under its actual value and your competition. The danger is in pricing it too high and haveing the house sit on the market for months.

How It Starts To Go Wrong

The seller of a home didn't interview her real estate agents. She pick the first agent off the Internet, or a friend, or someone else because, "He looked like a nice guy." The agent priced her house at $250k. After 90 days of sitting on the market, the listing expired.

It Continues To Go Wrong

The next agent she hired listed the house at $235k. Months passed and eventually she dropped the price to just under $220k, still no offers. A few people looked at the house, but no serious buyers came forward.

More Than a Year Later

By the time she hired the last agent list her house, the seller had grown exhausted and weary. It was now more than 12 months later. The seller and her agent then priced the home at $195k and it sold very quickly. The sad part is that the comparable sales in the neighborhood fully justified a price of $220k, but the home had been on the market for too long at the wrong price, and now the market had slowed.

Protect Yourself

The question is how much money an expired listings can cost a seller. The financial losses often exceed the extra mortgage payments and goes way beyond the cost of trying to keep you home spotless during the listing period. It affects the value that a buyer ultimately chooses to pay because it is no longer a "fresh" listing. It's now stale, dated, a home that was overpriced for too long. Don't let this happen to you. Don't be that seller of an expired listing. Be sure to hire a professional Realtor who will help you price your home correctly from the beginning. Your Realtor should have access to powerful tools that can help you determine the best list price for you house.

If you are thinking about buyer or selling a home in the Central Florida area or beyond, do not hesitate to get in touch with me and I will give you my expert opinion on your situation--- with no commitment and free of charge.

Filed Under

listings,

sellers

|

Leave a Comment

![]()

Homes not selling unless they are foreclosures?

Not true.

I just sold a beautiful 2 bedroom home in Thornton Park for $515,000 that closed last Friday. I represented both sides of the transaction. The home was my listing, and I marketed and found the buyers who ultimately purchased the property. This was not a short sale or a foreclosure. The home was on the market over 600 days with a number of different Realtors prior to me....I listed the home and got it under contract in 69 days.

Why?

- Even considering significant price decreases in some markets over the past 18 months, a home purchased several years ago could very likely sell for a profit today.

- While your selling price might be less than anticipated, you very likely can compensate for that on the buying side of the equation in today's market. There are still great deals out there, and interest rates are still hovering around all time lows. Remember, when the market turns...and it will...you may be able to get an outstanding price for your home, but if you will be purchasing another home you will be on the other side of the transaction. You will be scrambling, and probably will be forced to pay a premium for property under those market conditions.

- I would remind you of this- While short-term market conditions can fluctuate, housing continues to represent a strong ling-term investment. Since the start of real estate record keeping in 1968, national median existing-home prices rose every year until 2006 - a period that included early recessions and sales decline.

- The market is experiencing a major decline in available home inventory- as short sales and foreclosed properties continue to disappear.

It all comes down to this. Homes are selling. The Realtors who are selling homes in this challenging market are doing more than just posting their listing on the MLS, putting a sign on a yard and hoping for the best.

I made this particular sale happen for both buyer and seller by working with the appraiser to explain the value of this property, by utilizing many different media to get the word out to everyone and targeting a very specific set of buyers that would be interested in a home like this. These are just a few of the reasons I was able to sell 27 James Avenue in such a short time, and to get accomplished what the Realtors who had this listing before me--- could not.

If you are considering putting your home on the market, I would welcome the opportunity to evaluate your home and give you my opinions, thoughts and suggestions.....all for free. Just get in touch and I will try to help you anyway I can.

Before I come over to list your property, some think it is best to "tidy up" a bit. That's fine. You have to do what you have to do. But usually I am there to look through the clutter and figure out pricing and how to best market your home.

Before I come over to list your property, some think it is best to "tidy up" a bit. That's fine. You have to do what you have to do. But usually I am there to look through the clutter and figure out pricing and how to best market your home.

When we decide to move forward, it is extremely important to show your home's true potential. Not only what is but also what could be.

Regardless of the listing price whether it be $100,000 or ten million, here are 7 simple spruce up items you can do to help me show your home in the best light and make it attractive to potential buyers. Some are easy do it yourself projects and others may require professionals. Either way these items are well worth the effort and will help me help you get top dollar for your investment.

Let's start with the easiest and less costly and work our way up--

1) De-clutter and de-personalize–

Less is more and it doesn't cost a thing! Remove religious items, family photos, gadgets and knickknacks. You want your buyer to remember your house, not the wall of photos from your vacation in North Carolina.

2) Clean it up – I know you are busy, but grab the vacuum and the glass cleaner and get rid of those dust balls and smudgy windows. People do not want to envision themselves living in a dirty home.

3) Change out the hardware – Are your handles on your kitchen and bathroom cabinet doors dated? The most important piece of hardware is your front door handle. Make sure it looks good. Remember, a good first impression is priceless.it. Changing the hardware is a simple and cost effective way to modernize your space, making it look fresh and new.

4) Lights- Remove your old and tired light fixtures. Take a look at your cover plates. If they look outdated or stand out (in a bad way) change them out. Cover plates are cheap to replace yet make a huge difference in the appearance of a room. Oh and please do not have any burnt out bulbs. This is a pet peeve of MichaelGonickRealtor! I seriously think that subconsciously buyers decide not to buy homes that have a burnt out bulb anywhere in sight!

5) Paint – Freshen up the interior of your home with a new coat of paint. New paint smells great! Remember, neutral colors are best because they will make your rooms appear larger and will allow the buyer to envision their own furniture in the space.

6) Upgrade flooring – Now this depends on budget but if you can, replace old carpet with new or better yet...hardwood floors. If hardwood is way out of your budget, maybe tile or a good quality laminate will work (do me a favor and show me the laminate before you lay it!).

7) Kitchen Upgrades – The most important room in a home to many is the kitchen. If it’s not in your budget to do a total remodel, then consider replacing old appliances with stainless steel if appropriate. Appliances that look consistent will help make your home look uniform.

It is still a buyer's market, and you only have one chance to make a great impression. Do what you can to put your best foot forward and you will reap the rewards.

Hope this helps! If you have any questions, or if I can help in anyway....I am here for you.

Oh and if you have a friend that might like this sort of thing....send them to MichaelGonickRealtor!

Image above is one of my gorgeous listings.

1691 Palm Avenue in Winter Park

Home by Phil Kean

Filed Under

Articles by Michael Gonick,

preparation for sale,

sellers

|

1 Comment

![]()

Often a Realtor will be asked, "So what do you think about the market?" "When is it going to get better?" How I usually answer is this: The quicker we realize that it is not going to be what it was, the quicker we will be able to embrace the "New Normal."

I've seen it starting to happen. We are still in what would be considered a down economy yet we have had a string of good days on Wall Street. Home sales are starting to go up though the prices of homes....are not. I think we are beginning to come to grips with the fact that "this is it and this is how it is going to be".

Realistic sellers are facing up to the harsh reality that they will not get the big payday they expected from the house they bought in the "boom" a couple years back. Smart buyers who were once hesitant are realizing that with the combination of increased home sales and rising interest rates it is time to get off the sidelines.

The $8000 tax credit for first time home buyers will not be around forever- in fact it is due to expire by the end of this year.

Just as many have looked back and beaten themselves up for purchasing a house a couple of years ago when the market was topping out, there may be a slew of others who might very soon regret letting the opportunity of lifetime- the ability to purchase their dream home in a market that is beginning to lift its way out- slip through their hands.

Filed Under

Articles by Michael Gonick,

buyers,

economy,

markets,

sellers,

trends

|

Leave a Comment

![]()